In the past six months, RIL is down 15%, and Jio Financials is down by 28%.

“In the coming weeks and months, we will begin pruning our defensive exposure toward more cyclical and growth-oriented segments,” Quant Mutual Fund said in a recent communication to investors.

For context, the benchmark Nifty 50 is down 10% from its lifetime high of 26,216 points in September. When the cycle turns, Quant MF believes select high-beta small-cap stocks will rebound faster than the rest of the market.

“Allocations will gradually tilt in favour of very select high-beta names, particularly within the small-cap category, which are historically quicker to recover during market rebounds,” Quant wrote in its February factsheet. “Such a strategy aligns with the fund’s overarching philosophy of leveraging periods of market pessimism to build positions in high-potential areas.”

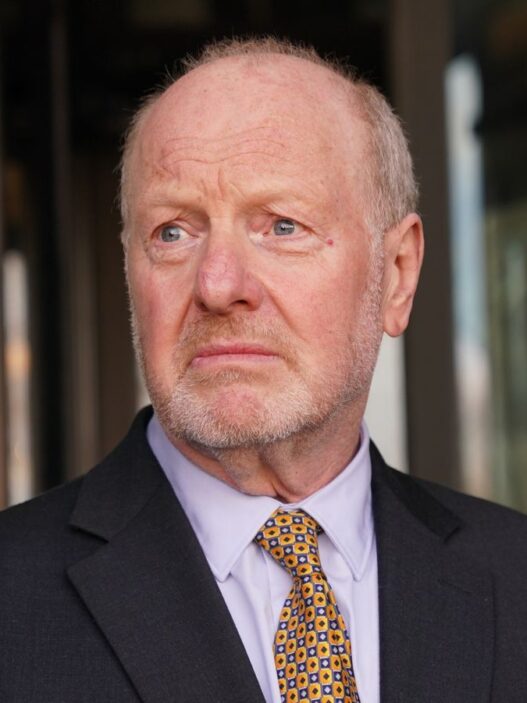

Mint caught up with Sandeep Tandon, founder and chief thought officer, Quant MF, for an interview. Edited excerpts:

You had invested in big conglomerate names (RIL & Adani) but it hasn’t worked out well. Would you tell us the reason?

In July 2024, we were early to talk about mild risk-off. At that point in time, we had said India’s macro situation is deteriorating. Not a single economist had downgraded India. By December, now the downgrades have begun. Everyone is now thumping that India has peaked out. In the game of risk management, you have to be early.

Right before August, we started talking about how the US dollar index was a perceived risk. Nothing happened but by September, the dollar started rising not only against the rupee but against the entire global currency. The currency market sensed the arrival of Trump earlier than anyone. What the market is implying, we try to reverse-engineer, we are not astrologers.

Now what do you do in a risk-off period, you move from high beta to low beta, mid and small to large caps, and to more liquid places. Come September 2024, when China’s unknown risk hit us. We call it unknown because money shifted quickly to China. We are part of EM (emerging market) and when China was doing badly in the last 4 years, we were beneficiaries of it.

It was a tactical shift in money. All these hedge funds and prop accounts, they don’t wait and shifted quickly to China. As they owned many large caps, we were affected. For a lot many people, dollars was an unknown risk; for us it was a known risk as it was predictable using analytics. What China will do now is unknown. What Trump will do is a known risk.

At the end of November, we said it was mild. Our risk-averse parameter deteriorated, they had covered 60% of the journey, which means only 40% of the journey is left. We wanted to leave some money on the table to the seller. It’s difficult to call the top. Now we’ll gradually move towards select high-beta small caps opportunities.

You are saying that large-cap bore the brunt of FII selling and money going to China, and your fund suffered. S. Naren of ICICI Pru recently said when the flow comes back, it will come back to large caps.

Right from July we are saying shift to large and mega-large caps. When have been telling investors to reassess their risk appetite? Right from February and March, Sebi also talked about liquidity aspects. At the peak of the market cycle, everyone has a high-risk appetite and everyone has a long-term vision. That’s an open fact.

After 2-3 months of downfall, they will realize that they never actually had any risk tolerance. Please analyze your own behavior otherwise it becomes a theoretical exercise. There’s a particular individual way of reacting, some people get really excited at the top and extremely nervous at the bottom. We as a found house cover these points. When we say we’ve completed 60% of the journey, we mean we are buying small caps whenever one is selling.

So you don’t agree with Naren’s assessment that when FII comes it’ll be in large caps?

No, I agree with the thesis, that’s why our core holdings are still in mega caps, but that doesn’t mean long-term SIPs in mid- or small-cap funds should be stopped. Historically, over longer durations, small- and mid-cap stocks have delivered better returns. Investors should reassess their risk appetite and allocate accordingly.

Your view is not so much on the valuation aspect. After all, small and mid-caps are overvalued from most metrics.

See, we are not slaves of just valuation analytics. So, valuation analytics is a vital framework but its only a third of the VLRT (valuation, liquidity, risk appetite, and time) framework. We also look beyond valuation. Out of the remaining two-thirds, one half is liquidity metric and the other is risk appetite. We combine all 3 aspects to arrive at the conclusion.

What sectors are you positive on?

Apart from consumption, we like the hotel sector. We have built a lot of exposure in that sector. We think that’s one area which will pick up. I went to so many destination weddings and it was difficult to get space in a hotel. We have a large exposure in the hotel industry now. We are optimistic on large infra as a thesis, select pharma, and energy.

Anything you don’t like?

I am an opportunist. Something that I don’t like today, I might go out and buy tomorrow. We don’t restrict ourselves.

Any development on the front-running case?

We do not comment on regulatory matters. As a house, we don’t want to comment on regulatory aspects. If anything happens, we’ll be the first to comment. We are committed to transparency.