India has the highest population of all the countries in the world. India also is the fastest growing economy among all the major economies. It is common knowledge that humans are the real capital of any civilization.

Further, with a large part of the Indian population aspiring to achieve financial independence quickly in years to come. This means amassing wealth during your 20s and 30s is the answer to almost all the financial problems in one’s life.

This question is more about the vision and orientation of an individual. It is about how vigilant, devoted and sincere you are towards your own financial future. The speed of economic growth in India and its relatively smaller size in comparison to the US and China puts it in prime position to continue its GDP growth trajectory the way it is going.

Hence, as a youngster in India, there are several important steps you can take to create a solid financial foundation for your future self. Some of them are elucidated below:

Where do you start amassing wealth?

First, you need to sit down with a piece of paper and a pen, jot down your expenditure and make a budget. Knowing your spend and income clearly ensures you budget your savings and investments accordingly. It prevents overspending and promotes informed spending.

Why should you start saving early?

Save early to make the most of the power of compounding i.e., compound interest. This will ensure that you will be earning a lot more money in the long term due to the effects of compounding. Saving little amounts from your 20s will have a compounding effect to save you a nest egg which will be sufficient to last for such a cost like retirement or for a house in the future years.

Therefore, following the well known thesis of Warren Buffett the founder of Berkshire Hathaway is of a lot of significance here. Buffett believes that saving as an idea is of immense importance and should be given the first priority: “Don’t save what’s left after spending, but spend what is left after saving.”

How can you diversify your investments?

Diversification is a way to distribute risk. Investment diversification is when you invest in various asset classes, i.e., stocks, bonds, and property. This is done to ensure that your portfolio chugs along merrily even if one of the asset classes stated above underperforms. You should try to reduce risk by making sure that a bad performance by one type will not hit your portfolio severely. Invest in a mix of risk and low-risk investments depending on your needs and risk taking capacity.

What is an emergency fund for?

We all need a buffer of money in a rainy-day fund that will serve as an insurance against unforeseen challenges and circumstances. For example: Redundancy at work or hospitalization. Saving three to six months’ living costs keeps you away from paying bills on credit cards or applying for high interest loans, where debt has the tendency to accumulate.

Do you need professional financial assistance and support?

Yes, with a financial advisor you can receive personal advice according to your financial condition and goals. They can assist you in designing a long-term financial plan, maximizing your investment plan, and remaining on target to accumulate wealth. All this according to your earning potential, current status of loan exposure and related liabilities.

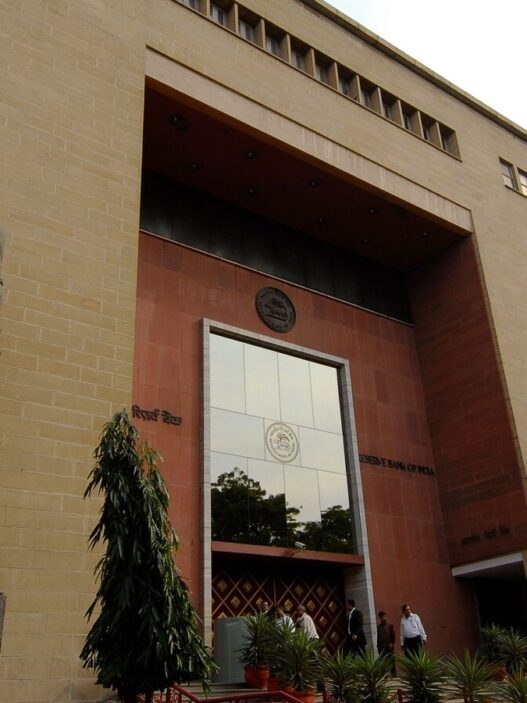

For building an investment portfolio and a long term strategy it is advisable to all aspirational wealth builders to consult a SEBI registered investment advisor. The details of the same can be obtained by the official website of SEBI: https://www.sebi.gov.in/

Hence, making these smart money decisions in your 20s and 30s will help in building immense wealth in the future. Being smarter about saving, beginning early to save, investing diversely, having an emergency fund, and consulting advisors will put you in the right position for exponential growth of wealth in the long term. Start today for a wealthier future!

(Disclaimer: Stock and mutual fund investments are subject to market risks, read all scheme related documents carefully.)

Catch all the Instant Personal Loan, Business Loan, Business News, Money news, Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess