In December, the Bengaluru bench of the Income Tax Appellate Tribunal (ITAT) passed an order citing three Supreme Court judgments and one Madras high court judgement that do not exist. In just a week, the order was withdrawn, citing “inadvertent errors”.

What is the case?

The case involving Buckeye Trust before the ITAT’s Bengaluru bench pertained to the taxability of a transaction in which a person settled (created) a trust worth ₹669 crore, mainly by transferring interest in a partnership to the trust. Normally, transfers without consideration to non-relatives above ₹50,000 are taxable in the hands of the recipient. However, Buckeye’s lawyers argued that interest in a partnership is not property within the meaning of the tax law, among other submissions.

After hearing the argument, the tribunal held that an interest in a partnership is indeed a type of “share” (like a stock market share) and hence taxable. The tribunal’s order in the case — Buckeye Trust vs PCIT-1 Bangalore (ITA No.1051/Bang/2024) — cited similar past judgements from the Supreme Court and high courts.

Interestingly, the judgements quoted do not exist. Mint’s research found that the original orders of four judgements listed on Page 28 of the ITAT tax order are not to be found in archives of either the Supreme Court or the Madras High Court.

“On looking up the exact citations and searching by party name on SCC, no such cases could be found,” confirmed Shashank Agarwal, advocate & founder of Legum Solis, a law firm. SCC stands for Supreme Court Cases, an online repository of SC case laws.

Two of these judgements—K. Rukmani Ammal v. K. Balakrishnan (1973) 91 ITR 631 (Madras High Court) and S. Gurunarayana v. S. Narasimhulu (2004) 7 SCC 472 (Supreme Court of India)—do not have any records at all.

The citation of the third one—Sudhir Gopi v. Usha Gopi (2018) 14 SCC 452 (Supreme Court of India)—leads to a different case altogether of K. Subba Rao v. State of Telangana. The fourth citation, 57 ITR 232(SC), does have a case law of CIT Vs Raman Chettiar, but it’s an entirely different case related to a Hindu Undivided Family.

“We have been unable to find the following cases by name or citation: Sudhir Gopi v. Usha Gopi (2018) 14 SCC 452 (Supreme Court of India), S. Gurunarayana v. S. Narasimhulu (2004) 7 SCC 472 & K. Rukmani Ammal v. K. Balakrishnan (1973) 91 ITR 631. They only find a place in the ITAT order,” said Prasouk Jain, managing partner at LPJ and Partners LLP.

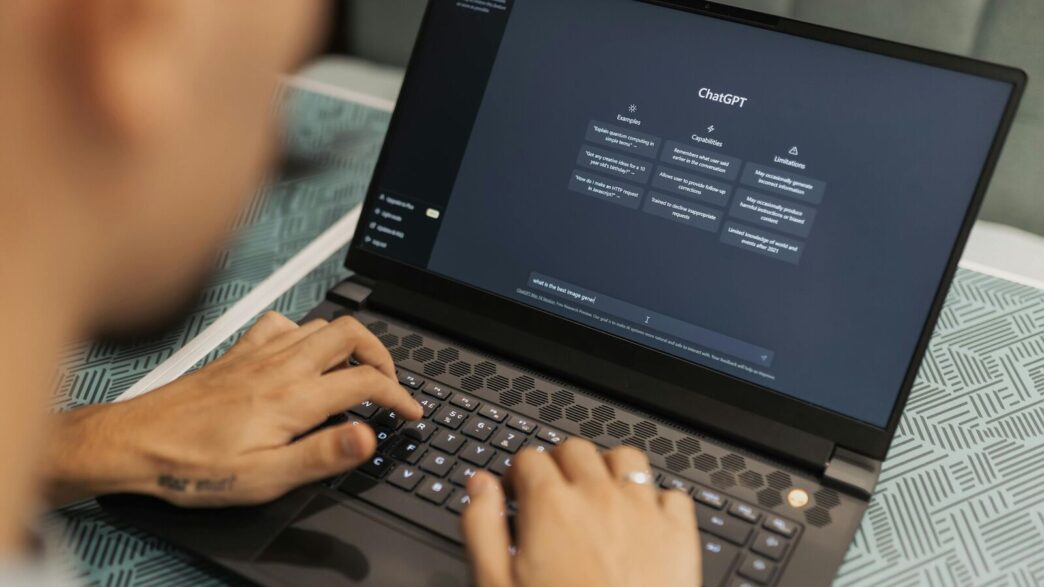

Who used ChatGPT?

“The Supreme Court judgment in Raman Chettiar, cited in the order, did not deal with partnership interests. Instead, it addressed whether a tax return filed under a defective notice was invalid. Additionally, some other cited cases may have incorrect references or possibly may not exist,” said Abhay Sharma, a partner at Bombay Law Chambers.

According to a person who has tracked the case, the tax department’s representative (DR) possibly relied on a generative AI tool like ChatGPT to search for verdicts favouring the tax department, and used them in his argument. “The bench also just copied and pasted the case laws on the submission of the DR without carrying out due diligence on their end,” the person said on the condition of anonymity.

Mint could not verify this claim independently as queries to the Central Board of Direct Taxes (CBDT) and the ITAT head office about the source of these non-existent judgements that made it to the order remained unanswered. Questions sent to one of the ITAT bench members who heard the case also did not receive a response.

Generative AI is known for occasionally “hallucinating,” when chatbots such as ChatGPT and Gemini generate output that appears factual or logical but are fabricated or nonsensical. To be sure, it could not be confirmed if such AI hallucination led to the error creeping in.

Also, while it is true that tribunals typically pass orders based on the arguments, which include relevant past judgements made by the assessee and the DR, it is not uncommon for the tribunal members to identify the right verdict and quote them in orders when either of the two parties fails to give the exact citations. Hence, it’s possible that the error may have crept in at the bench’s end as well.

A chartered accountant (CA) who takes up litigation cases in tribunals said that the use of ChatGPT has become a common practice for guidance when preparing arguments. “But it can’t be fully relied upon in legal contexts, and hence, everyone must carry out due diligence in legal research even if using ChatGPT,” the CA said on the condition of anonymity.

Mint also couldn’t ascertain if the tax order was recalled because of reliance on these fictitious case laws, or for any other reason, as the ITAT didn’t clarify what the “inadvertent error” was that caused the order to be recalled.

Counsels representing the assessee, Buckeye Trust, refused to comment when asked if they knew the tribunal bench’s reasons for recalling the order.