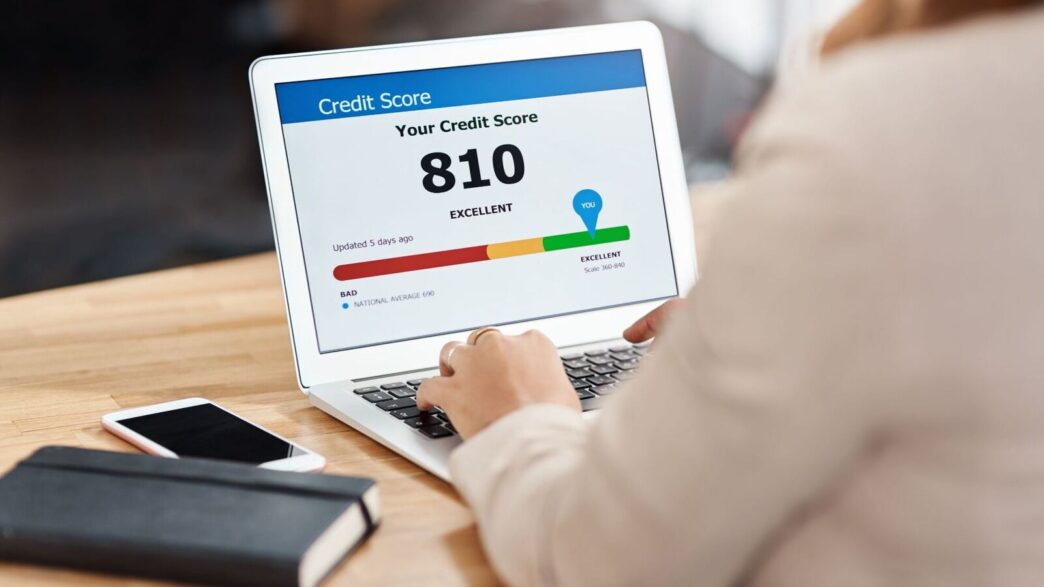

If you hold a credit card or have a running personal loan, it is recommended that you check your credit score from time to time. Typically, one should check the credit report at least once a year to stay abreast of one’s creditworthiness.

The following are the key reasons why one must check their credit score from time to time.

Check your credit score: 7 key reasons

I. Optimum interest rate: When your credit score is high, you can bargain for a low interest rate. And conversely, when your credit score is low, you can bargain for a high interest rate.

II. Spot an error: In case you spot a mistake in your report, you can approach the credit information company to get the mistake rectified.

III. Steps to improve your score: Sometimes, you need to take steps to improve your credit score, such as improving the credit mix or lowering the credit utilisation ratio. You can learn these things only by checking your credit score on a regular basis.

IV. Get to know about the fraud: If someone has opened a loan or credit card using your documents—although there is a remote possibility of this—it will reflect on your report. An annual check can help you catch any such fraud as early as possible and act upon it as well.

V. Know where you stand: Your credit score has a bearing on your ability to obtain loans or credit cards. As you check your score, you can find out if your score is excellent, average or bad.

VI. Aids in financial planning: Checking your credit on a regular basis can help you keep track of your progress if you are trying to build or repair your credit. It gives you a peek into how your financial habits influence your score.

VII. Soft inquiry: Unlike the popular perception, checking the credit score does not lead to loss of score. Checking the score leads to soft inquiry which does not adversely impact the credit score.

Disclaimer: Mint has a tie-up with fintechs for providing credit, you will need to share your information if you apply. These tie-ups do not influence our editorial content. This article only intends to educate and spread awareness about credit needs like loans, credit cards and credit score. Mint does not promote or encourage taking credit as it comes with a set of risks such as high interest rates, hidden charges, etc. We advise investors to discuss with certified experts before taking any credit.